richmond property tax calculator

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Property value 100000.

Toronto Property Taxes Explained Canadian Real Estate Wealth

1000 x 120 tax rate 1200 real estate tax.

. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Richmond County Tax. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Michigan laws must be followed in the citys conduct of taxation.

The median property tax on a 7130000 house is 55614 in North Carolina. Richmond Hill real estate prices have increased by 15 from November 2019 to November 2020 and the average price of a home in Richmond Hill is 12M. Richmond property tax calculator.

This property tax calculator is intended for approximation purposes only. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Richmond County. The City Assessor determines the FMV of over 70000 real property parcels each year.

When summed up the property tax burden all owners bear is established. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

By Richmond City Council. Calculate how much youll pay in property taxes on your home. Reserved for the county however are appraising real estate sending out bills taking in collections implementing compliance and addressing conflicts.

The median property tax on a 7130000 house is 73439 in Richmond County. Taxation of real property must. The median property tax on a 7130000 house is 74865 in the United States.

Personal Property Registration Form An. Once market values are recorded Richmond along with other in-county governing units will calculate tax rates alone. Home City Hall Finance Taxes Budgets Property Taxes Tax Rates.

Real property appraisals are done by the county. Richmond Hill has partnered with Paymentus Corporation a third-party service provider to bring you the convenience of paying your property tax online with your Visa or Mastercard. This is largely a budgetary function with entity administrators first estimating annual spending expectations.

For comparison the median home value in Richmond County is 9930000. Actual property tax assessments depend on a number of variables. If you cannot find your assessment notice property owners can visit wwwmpacca and select the Property Owners option at the top menu bar then click on AboutMyPropertyTM or call Access Richmond Hill at 905-771-8949.

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Suitable notice of any levy raise is also a requirement. Once again Ohio has enacted statutes which county property.

Property Value 100 1000. Property taxes are calculated based on the assessment values set by BC Assessment. The population of Richmond Hill increased by 5 from 2011 to 2016.

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Richmond Hill Property Tax 2021 Calculator u0026 Rates.

3 Road Richmond British Columbia V6Y 2C1. Richmond determines tax rates all within the states regulatory guidelines. Counties undertake property appraisals for cities and special public units.

August 7 2021 adnecasino No comments. Under the state Code reexaminations must occur at least once within a three-year timeframe. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established.

Usually new assessments use an en masse strategy applied to all alike property in the same locality without individual property tours. A 10 yearly tax hike is the maximum raise allowed on the capped properties. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Richmond County.

To get your exact property tax liabilities contact the Richmond County Tax Assessor. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. These documents are provided in Adobe Acrobat PDF format for printing.

Reserved for the county however are appraising property issuing billings taking in collections carrying out compliance and resolving disputes. While observing legal restraints mandated by statute New Richmond enacts tax rates. 1 be equal and uniform 2 be based on up-to-date market worth 3 have a single estimated value and 4 be held taxable in the absence of being specially exempted.

Personal Property Taxes are billed once a year with a December 5 th due date. Single-family detached houses are by far the most commonly sold property type on the Richmond Hill real estate market accounting. For comparison the median home value in Richmond County is 14870000.

Richmond Hill Property Tax 2021 Calculator u0026 Rates GTA Cities With The Highest And Lowest Property Taxes Heres How Torontos Property Tax Rates Compare to Other Ontario. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. New York has 62 counties with median property taxes ranging from a high of 900300 in Westchester County to a low of 167400 in St.

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Toronto Property Tax 2021 Calculator Rates Wowa Ca

Residential Property Tax Calculator

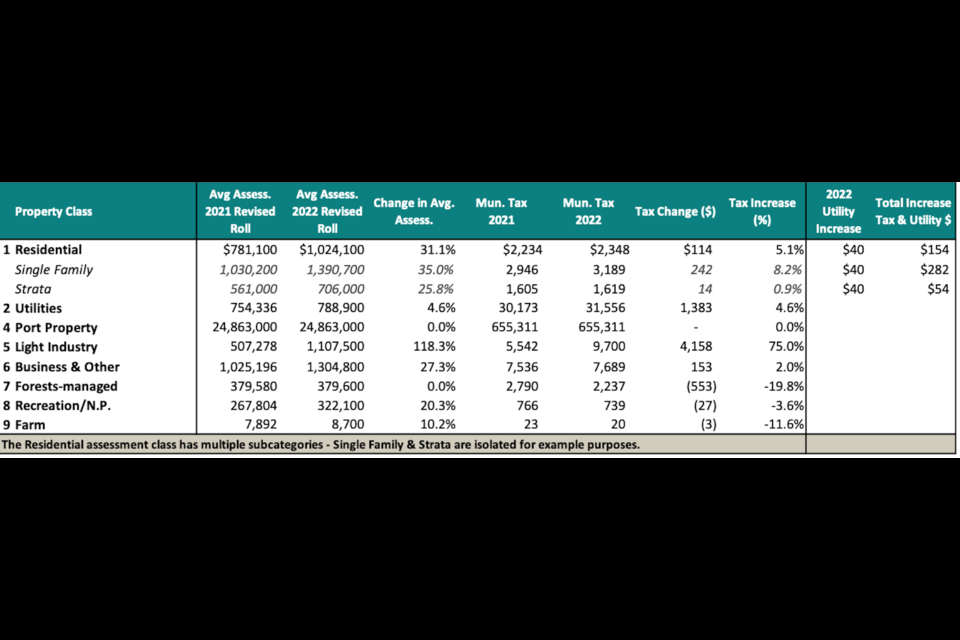

How Much Are Squamish Property Taxes In 2022 Squamish Chief

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Property Tax Richmond County School System Lowers Mill Rate Raises Taxes

Mississauga Boasts 11th Lowest Property Tax Rate In Ontario Insauga

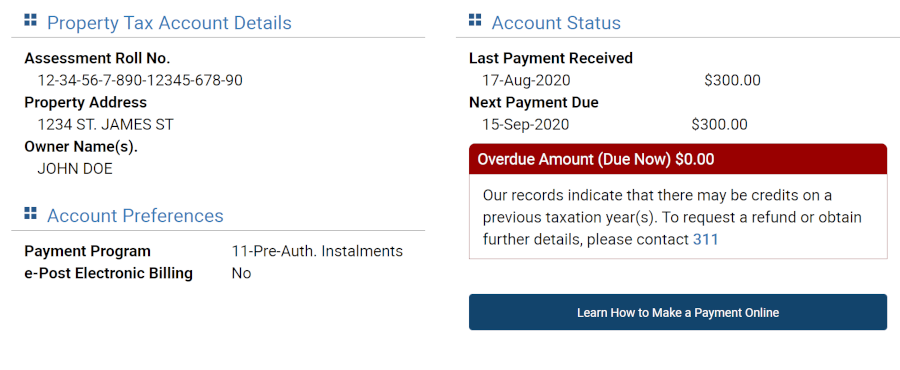

About Your Tax Bill City Of Richmond Hill

About Your Tax Bill City Of Richmond Hill

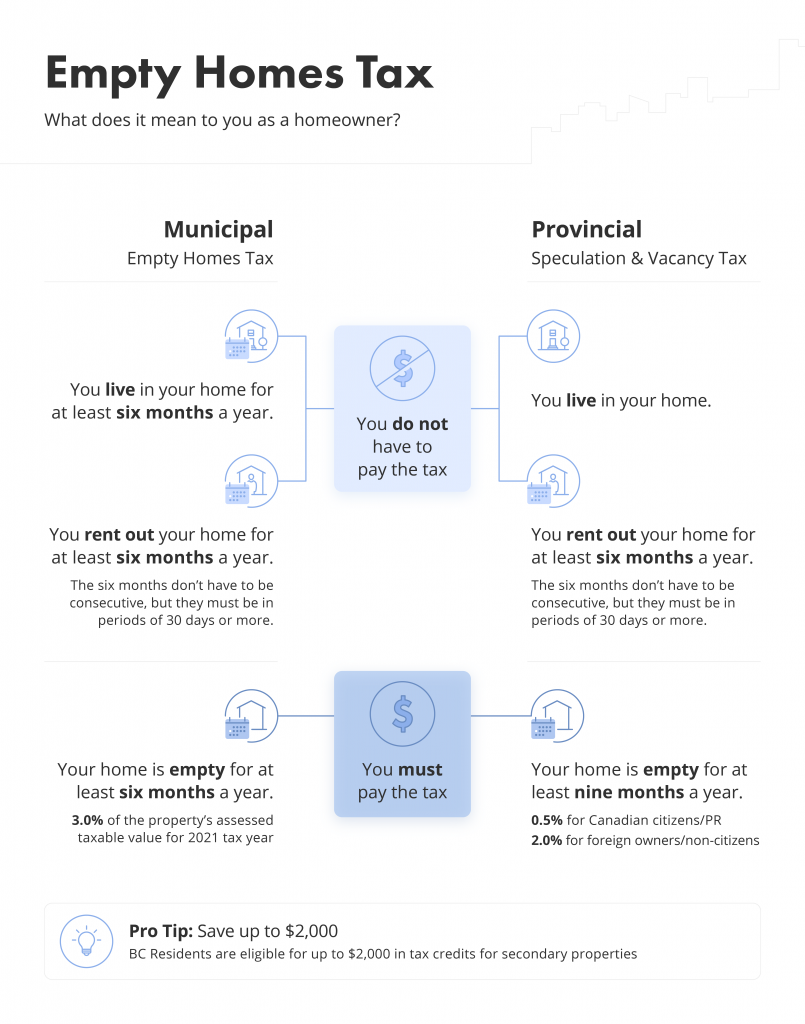

Updated For 2022 Homeowner S Guide To Bc Taxes Property Tax Empty Homes Tax More Liv Rent Blog

Ontarians Face Growing Property Tax Burden In Many Municipalities Fraser Institute

About Your Tax Bill City Of Richmond Hill

Residential Property Tax Calculator

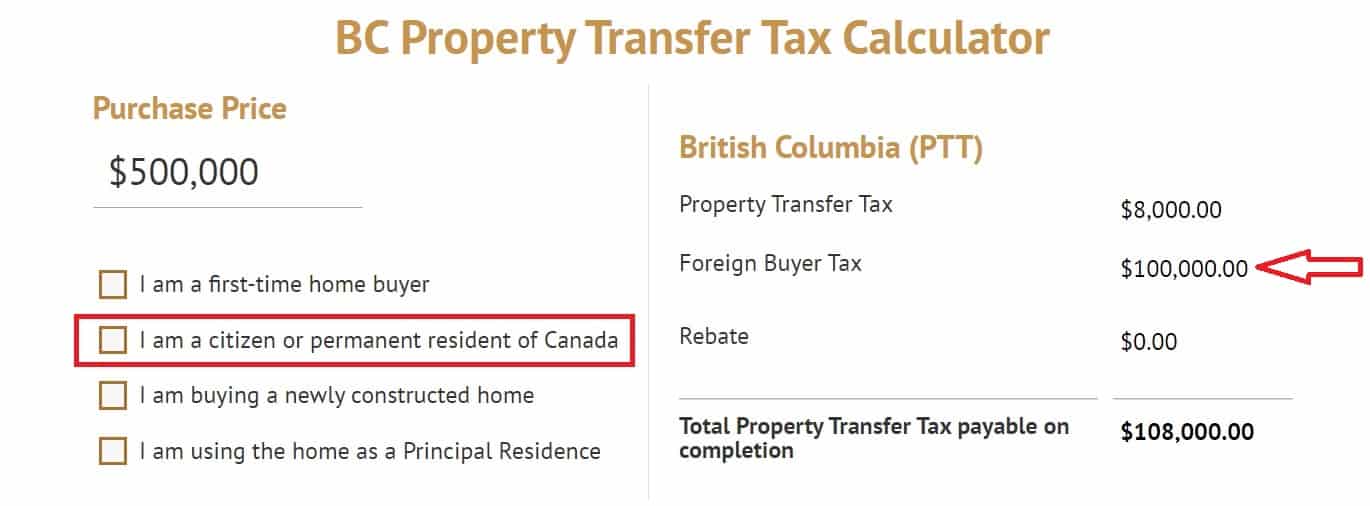

The Ultimate Guide To Vancouver Bc Foreign Buyer Tax

How Much Are Squamish Property Taxes In 2022 Squamish Chief

Here S How Mississauga S Property Taxes Compare To Other Ontario Cities Insauga